Anson Blog

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- 401(k) Providers

- Anson's Monthly Planner

- Individual Investing

- Investment Fundamentals

- Market Commentary

- Podcasts

- Quicktakes

- Retirement

- Uncategorized

- All

- 401(k)

- 401(k) Providers

- 401kplan

- Active

- Active management

- adviser

- advisor-client relationship

- asset allocation

- assets

- Automatic Enrollment

- babyboomers

- Bear Market

- Benchmarking

- Benchmarking Fees

- benefits

- Best Practices

- Bonds

- Bull Market

- CDs

- charity

- congress

- cybersecurity

- data

- Debt

- Digital connectivity

- Diversifcation

- diversification

- diversified portfolio

- downturns

- Economy

- education funding

- emerging economies

- Emotions

- employment

- ERISA

- ERISA 404(c)

- excessive fees

- Fed

- Fiduciaries

- Fiduciary

- financial adviser

- financial planning

- financialwellbeing

- Future Performance

- housing

- Index Funds

- Individual Investing

- Inflation

- interest

- interestrates

- Investing

- Investment Behavior

- Investment Fundamentals

- investment opportunities

- Investment Policy Statement

- legacy

- liability

- litigation

- Long-term Investing

- macrotrends

- manufacturing

- Market Trends

- markets

- Millennials

- monthlyplanner

- Morningstar

- Mutual Funds

- Passive

- Passive Management

- pensionplans

- Perceived performance

- Plan Committees

- prudence standard

- quarterlyreport

- Ratings

- recency bias

- recoveries

- retirement

- Retirement Plan

- retirementplan

- retirementplanning

- returns

- Rising Rate Environment

- risk

- Roth IRA

- saving

- Sector Investing

- secureact

- security

- SRI

- stock market

- Target Date Fund

- tax

- Tax Planning

- TDF

- Third Part Fiduciary

- Traditional IRA

- vacation

- veteran

- volatility

- wealth management advice

January 25, 2017

As a company that works with both individual and institutional investing, we try to send out information that could be useful for both types of clients. For instance, our posts on diversification, emotional investing, and long-term investing can give guidance to any investor! But every now and then we will […]

January 11, 2017

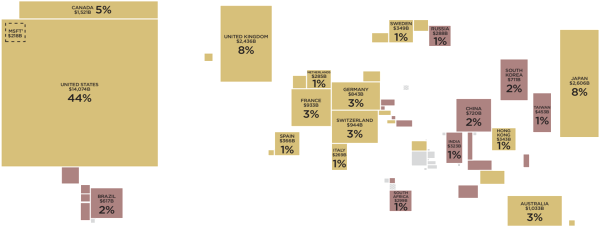

We hear it a lot: “Made in America” and “Keep our jobs at home,” but what about our stocks? Does the same apply to the markets in which we invest? Many people tend to concentrate their investments in their home stock market automatically. This means that a lot […]

December 28, 2016

Have you ever been to a fortune teller? Or been tempted by the promise of answers to your future? It is a common desire, to want to be sure that your future is the best it can be. The same even applies to investing. Many times, movements in […]

December 21, 2016

Good news! This just in! Capital markets reward long-term investors! Ok, it isn’t really new information, but it is always encouraging to hear it again, When financial markets are the main investment avenue it is reassuring to know that free markets provide a long-term return that offsets the […]

December 9, 2016

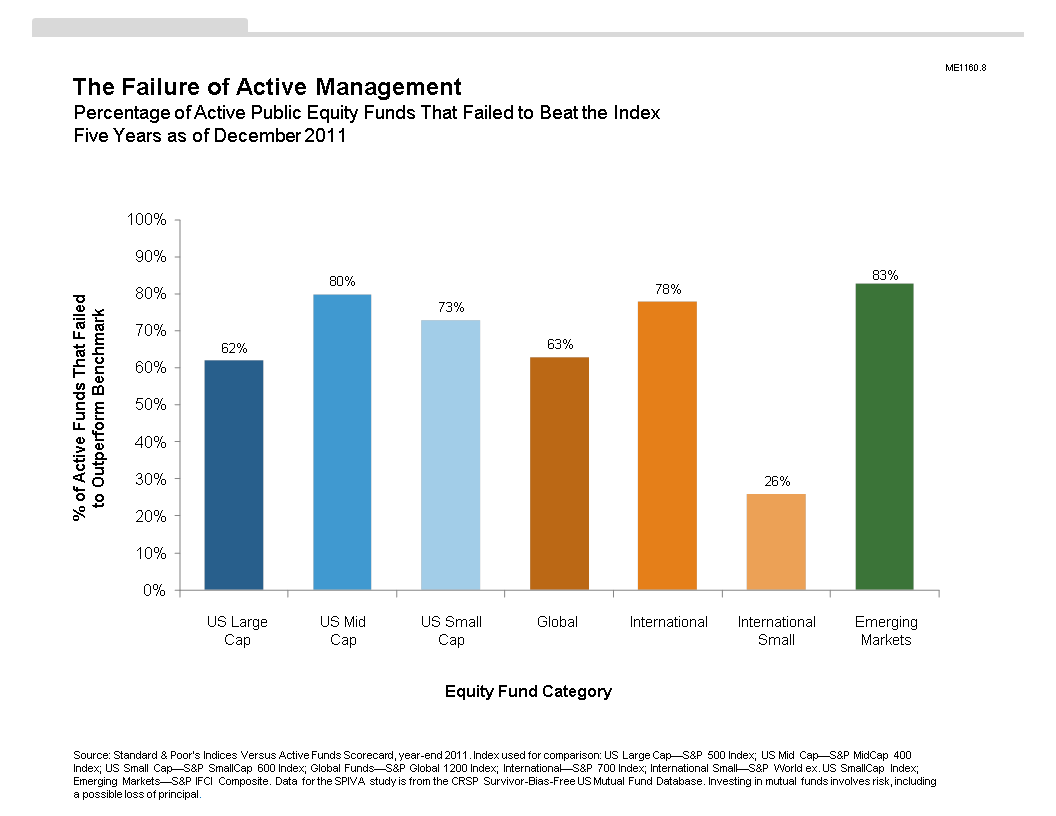

It is an essential investment decision: actively managed mutual funds or index funds? Actively traded investments, outsmarting the market, and “playing the game,” or investing in the index and playing it safer? Whether you are a risk-taker or a risk-adverse investor, you need to know that index funds […]

July 11, 2016

The difference in returns among portfolios is largely determined by relative exposure to the market, small cap stocks, and value stocks. Stocks offer higher expected returns than fixed income due to the higher perceived risk of being in the market. Many economists further believe that small cap and […]

July 10, 2016

Volatility is the least recognized destroyer of wealth. Most investors have no idea of its negative impact. If two portfolios average 10% per year, shouldn’t they be equivalent? Not exactly. Consider the example above: Both portfolios have an average return of exactly 0%. Both portfolios begin year 1 […]

June 30, 2016

Research by Eugene Fama and other financial academics has offered evidence that the bond markets are efficient and that interest rates and bond prices do not move predictably. This appears to be the case with all types of issues, from short-term government instruments to long-term corporate bonds. This […]

June 15, 2016

Investors who flee the stock market for the safety of cash may experience temporary relief from market volatility. But after leaving stocks, their anxiety may shift to concern over missing a stock market rebound while sitting in cash. The above performance data offer a recent example of the […]

June 28, 2016

The cartogram above displays countries by the ratio of their stock market value to the world’s total market value (free-float adjusted). People invest in various countries’ markets based on factors such as population, GDP, and exports, but more generally, investors gravitate to markets offering the optimal risk-adjusted expected returns. Highlighting […]

Considering Morningstar a Fiduciary is a Bad Idea