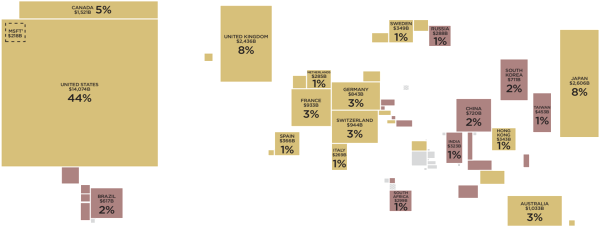

World Market Capitalization

Perils of Market Timing

June 15, 2016The cartogram above displays countries by the ratio of their stock market value to the world’s total market value (free-float adjusted).

People invest in various countries’ markets based on factors such as population, GDP, and exports, but more generally, investors gravitate to markets offering the optimal risk-adjusted expected returns. Highlighting this trend of efficient markets, the cartogram provides a measure of a given country’s investible opportunity in relation to that of the world’s opportunity. Therefore, rather than analyzing individual economic factors, one may observeserve the aggregate effect of those factors, yielding a more disciplined and strategic approach to global investing.

As investors move capital to more attractive markets, the ratios of the countries displayed in the cartogram will change. Consequently, Israel is now classified as a developed market, and Colombia, Egypt, and Peru are now considered to be emerging markets.