How To Beat Inflation

Considering Morningstar a Fiduciary is a Bad Idea

December 14, 2016The Myth of Predicting Investment Behavior

December 28, 2016Good news! This just in! Capital markets reward long-term investors!

Ok, it isn’t really new information, but it is always encouraging to hear it again, When financial markets are the main investment avenue it is reassuring to know that free markets provide a long-term return that offsets the impact of inflation. Stay with your investments for the long haul and the results will be more beneficial than short-term investing.

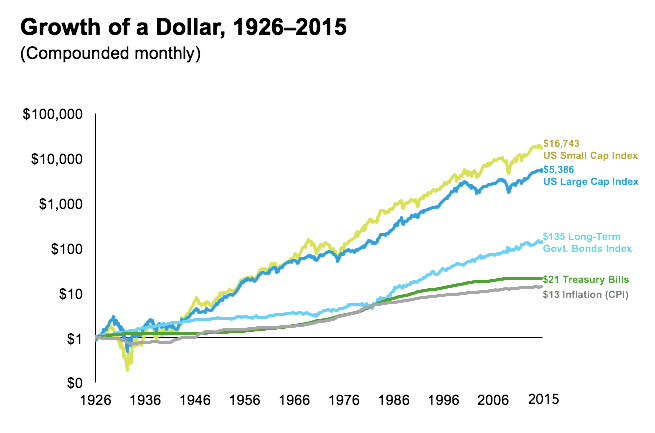

In the growth of wealth graph provided below this good news is documented. The graph shows the monthly performance of different indices as compared with inflation since 1926. The indices represent different areas of the US financial markets, showing stocks, bonds, and treasury bills.

The data shows in particular how beneficial stocks are in creating wealth over time. If you notice, treasury bills barely covered the inflation and long-term bonds did provide higher returns over the same rate of inflation, though not by much. US stock returns, though, exceed inflation by a noticeably higher rate, therefore significantly outperforming bonds.

It is important to note that not all stocks and bonds are the same, nor will they all have guaranteed results. For example, if we consider the performance of US small capital stocks versus large capital stocks over the same time period we see that the results are not equal. A dollar invested in small capital stocks in 1926 would be worth more than five times that of a large capital stock invested at the same time when evaluated in 2014.

No matter what, always remember that there is going to be some level of risk and uncertainty in markets. History doesn’t prove the future, nevertheless, the market is going to price securities in a way that reflects the positive expected future return.