The Failure of Active Management

Perils of Market Timing

June 15, 2016

Why is Volatility Important?

July 10, 2016Research by Eugene Fama and other financial academics has offered evidence that the bond markets are efficient and that interest rates and bond prices do not move predictably. This appears to be the case with all types of issues, from short-term government instruments to long-term corporate bonds.

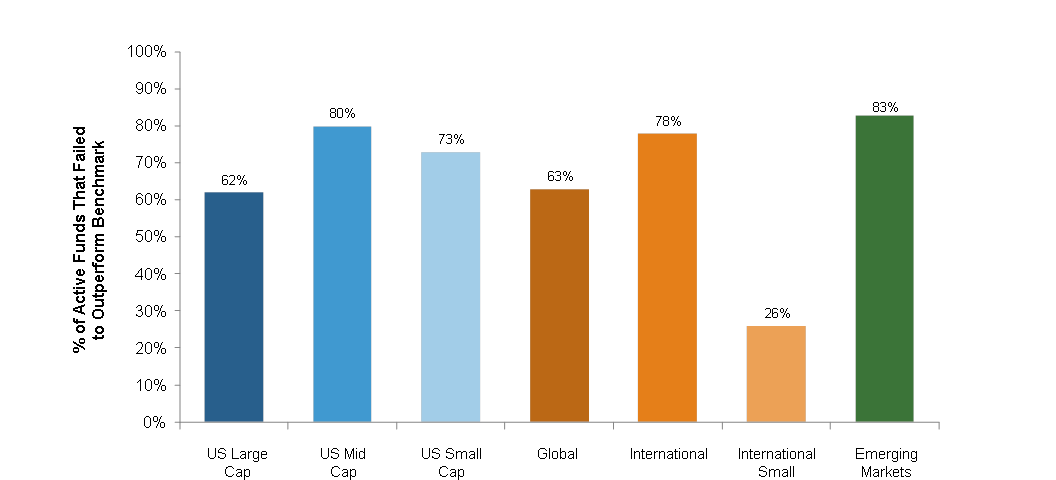

This slide illustrates the formidable challenge that active bond managers face. The graph shows the percentage of active fixed income funds in each category that failed to beat their respective market benchmark for the five-year period ending December 2011. All categories had at least a 61% failure rate, with failure defined as under performing their benchmark.

This is consistent with financial theory and research, which propose that active managers cannot outperform the market as a group, particularly after accounting for management fees, trading costs, and other expenses

1 Comment

[…] A plan for asset allocation is called an investment policy. Deviations from policy are intended to add value, namely alpha, but these attempts are well documented to actually subtract value. […]