Be Smarter Than Your Friends: Choose an Index Fund

All Investment Advisers Are Not Created Equal

October 4, 2016

Considering Morningstar a Fiduciary is a Bad Idea

December 14, 2016It is an essential investment decision: actively managed mutual funds or index funds? Actively traded investments, outsmarting the market, and “playing the game,” or investing in the index and playing it safer? Whether you are a risk-taker or a risk-adverse investor, you need to know that index funds are generally the way to go.

Mutual funds are all about trying to outsmart a market that very few people have succeeded in intentionally outsmarting. Fund managers for mutual funds think that they can identify “mis-priced” securities and use that knowledge to produce higher returns, but it very rarely works that way. The majority of mutual funds consistently under-perform their benchmarks.

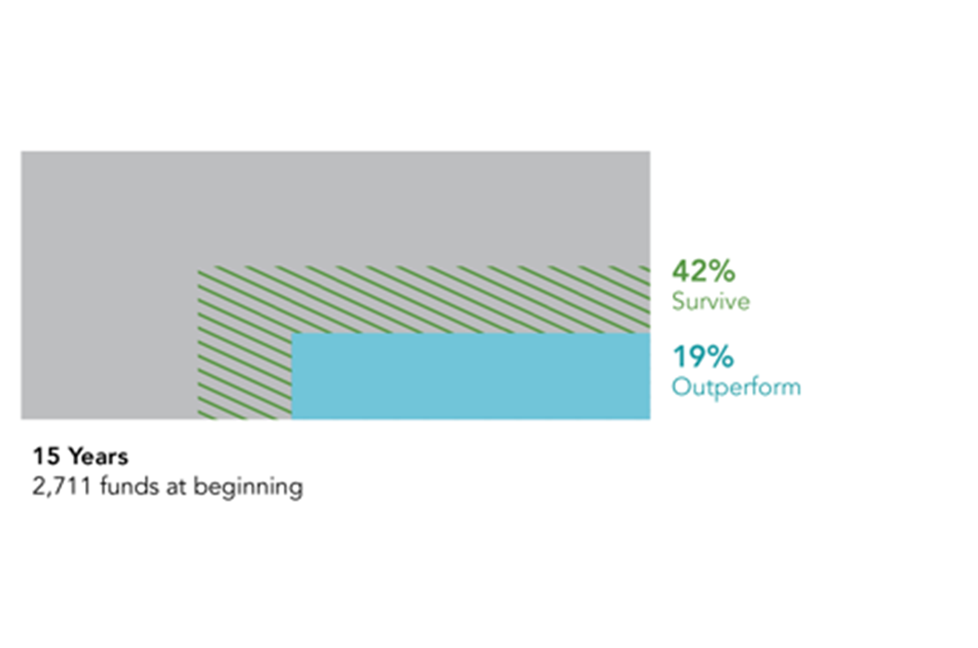

The chart illustrates the facts/ The gray box is the number of US-domiciled equity funds in operation over the last 15 years. The striped area is the proportion of those funds that survived the 15-year period and made it to the end of 2015.

As you can see, the survival rate was only 42%, not a very promising statistic in and of itself. Now, check out the blue-shaded area. It shows that only 19% of the equity funds both survived and out-performed their benchmarks. In the world of investments, that isn’t very good odds. 1 in 5 are actually terrible odds, particularly when it comes to your investments. This shows that barely any mutual funds are consistently beating the market in the long term.

So the advice her is to be smart with your investments. Don’t think that the facts will be different for you. Mutual funds don’t meet the goals you desire, so choose an index fund. Index funds meet their benchmark a majority of the time, meaning better returns for the client. Be smart and don’t think that you or your team is smarter than every other mutual fund manager out there.