One Way to Truly Diversify

The Myth of Predicting Investment Behavior

December 28, 2016

6 Steps to a 401(k)

January 25, 2017We hear it a lot: “Made in America” and “Keep our jobs at home,” but what about our stocks? Does the same apply to the markets in which we invest?

Many people tend to concentrate their investments in their home stock market automatically. This means that a lot of people are limiting themselves to only US stocks, and still considering that portfolio diversified.

Other times investors are only holding a small group of securities but thinking they have covered the market completely. But is that the best way to invest? Is that truly diversified?

What if we thought about diversification differently? What if we invested from a global perspective? If we think globally, limiting one’s investment world to only a handful of stocks from one national market is a concentrated strategy that has negative risk and return implications.

Embracing true diversification and investing in both the national US market and the global market actually provides a more balanced investment portfolio.

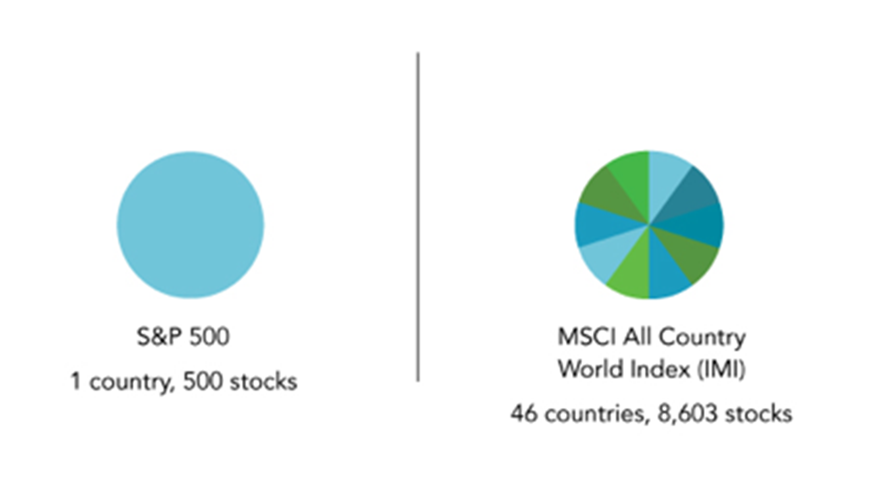

The image below shows a conceptual comparison between investing only in the US market, as represented by the S&P 500 Index, and investing in a globally diversified portfolio that includes worldwide markets, as represented by the MSCI All Country World Index (IMI). It can be seen that holding over 8,600 stocks in 46 countries broadens the investment universe and provides more opportunities,

Lesson to be learned? Embrace the global market and design a diversified portfolio that holds multiple asset classes in multiple market areas around the world. This will reduce risk and lead to a more well-rounded portfolio.