Anson Blog

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- 401(k) Providers

- Anson's Monthly Planner

- Individual Investing

- Investment Fundamentals

- Market Commentary

- Podcasts

- Quicktakes

- Retirement

- Uncategorized

- All

- 401(k)

- 401(k) Providers

- 401kplan

- Active

- Active management

- adviser

- advisor-client relationship

- asset allocation

- assets

- Automatic Enrollment

- babyboomers

- Bear Market

- Benchmarking

- Benchmarking Fees

- benefits

- Best Practices

- Bonds

- Bull Market

- CDs

- charity

- congress

- cybersecurity

- data

- Debt

- Digital connectivity

- Diversifcation

- diversification

- diversified portfolio

- downturns

- Economy

- education funding

- emerging economies

- Emotions

- employment

- ERISA

- ERISA 404(c)

- excessive fees

- Fed

- Fiduciaries

- Fiduciary

- financial adviser

- financial planning

- financialwellbeing

- Future Performance

- housing

- Index Funds

- Individual Investing

- Inflation

- interest

- interestrates

- Investing

- Investment Behavior

- Investment Fundamentals

- investment opportunities

- Investment Policy Statement

- legacy

- liability

- litigation

- Long-term Investing

- macrotrends

- manufacturing

- Market Trends

- markets

- Millennials

- monthlyplanner

- Morningstar

- Mutual Funds

- Passive

- Passive Management

- pensionplans

- Perceived performance

- Plan Committees

- prudence standard

- quarterlyreport

- Ratings

- recency bias

- recoveries

- retirement

- Retirement Plan

- retirementplan

- retirementplanning

- returns

- Rising Rate Environment

- risk

- Roth IRA

- saving

- Sector Investing

- secureact

- security

- SRI

- stock market

- Target Date Fund

- tax

- Tax Planning

- TDF

- Third Part Fiduciary

- Traditional IRA

- vacation

- veteran

- volatility

- wealth management advice

May 31, 2017

In all sectors of business, people are talking about Millennials. This generation, or those born from the early 1980s to the early 2000s, has shifted the status quo. Their worldview, their desires, and their expectations have presented a new challenge for businesses. So how does this emerging workforce […]

May 26, 2017

Investors who have been automatically enrolled in their company’s 401(k) plan have a good chance of being placed in a Target Date Fund. TDFs are increasingly popular among 401(k) plans and can be a wise investment choice for participants of all ages. Though one of the benefits of […]

May 24, 2017

When it comes to movements in the stock market, many investors want to believe that they can predict the future. They are tempted to switch asset classes based on perceived predictions of future performance, but the reality is that very little about the stock market can be accurately predicted. One […]

May 19, 2017

Many 401(k) plan sponsors choose to create committees to help manage the company’s retirement plan. These are typically called “retirement plan committees” or “administrative committees.” Since this group of people is responsible for making policy and investment decisions for their company’s plan, their fiduciary responsibility is significant. Retirement […]

May 12, 2017

THE MONTH IN BRIEF In April, investors kept one eye on impressive corporate earnings and another on geopolitical developments in Asia and Europe. Earnings ultimately drew the most attention – the Dow Jones Industrial Average rose more than 1% for the month, while the Nasdaq Composite added more […]

May 10, 2017

It has been surveyed time and time again and the results are the same- Americans are simply not saving enough for retirement. A startling 29% of those aged 55-64 have no retirement savings, and only 50% of Americans actually participate in their offered 401(k) programs. Though different reasons are […]

May 5, 2017

Much of the current litigation against 401(k) providers addresses the improper allocation of fees under the Employee Retirement Income Security Act (ERISA) section 406. But is it possible that the actual argument falls under ERISA section 404, the prudence standard? How is litigating fees and litigating prudence connected? […]

May 3, 2017

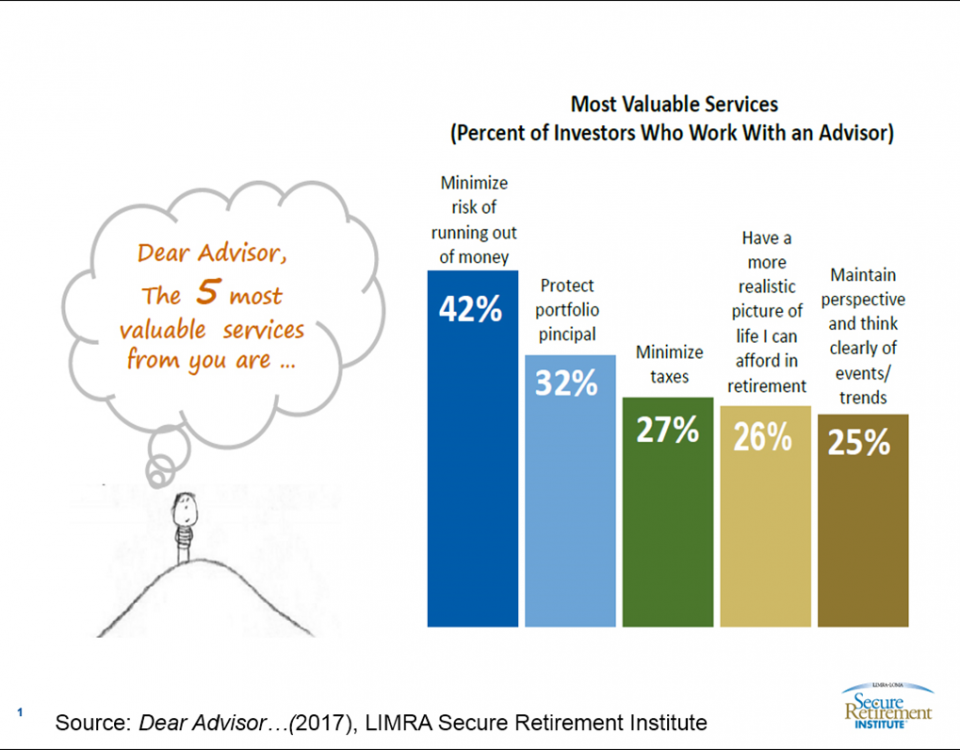

The shape of retirement is changing. As life expectancy increases and retirement lasts longer, more intensive and intentional retirement planning is required. Many individuals planning to retire are focusing less on corporate retirement options and more on individual retirement planning. This requires individual investors to take great care […]

April 28, 2017

Fee transparency has become a major focus of the Department of Labor in recent years. It is incumbent on plan sponsors to document that they are meeting all requirements for fee evaluation. Sponsors should guarantee that all compensation paid to service providers is reasonable in terms of the […]

April 26, 2017

Only 17% of U.S. equity mutual funds have survived and outperformed their benchmarks over the last 15 years. When it comes to choosing the funds for a company’s 401(k) plan, the truth is that the deck is stacked against the decision-maker. A study by the Wall Street Journal […]

April 21, 2017

The terms “bear” and “bull” are commonly used to describe the financial market, but how do they actually affect an investor’s portfolio? How should an investor react to these market shifts? Here are some general descriptions of these market movements and some common strategies for how to adjust […]

Should I Still Be Investing in Bonds?