Retirement Preparedness may Improve with an Adviser

Litigating Fees and Prudence- How do they relate?

May 5, 2017

Monthly Economic Update

May 12, 2017It has been surveyed time and time again and the results are the same- Americans are simply not saving enough for retirement. A startling 29% of those aged 55-64 have no retirement savings, and only 50% of Americans actually participate in their offered 401(k) programs. Though different reasons are cited for America’s lack of retirement savings, one survey found that for as many as two thirds of Americans, investing simply feels too complex and confusing (Prudential).

Pre-retirees, or workers between the ages of 50 and 75, are among those closing in on retirement while still feeling unprepared. A surveyed 75% of pre-retirees find planning for retirement to be somewhat or very complex. 40% of those surveyed claim to have no idea what to do when it comes to their savings.

This feeling of uncertainty has potentially resulted in the delay in saving for retirement, as the intimidation today overwhelms the foresight for tomorrow. This has also led to 74% of pre-retirees surveyed believing that they should be doing more to prepare for retirement, but few taking the necessary action. In fact, 23% of pre-retirees surveyed did not think that they will be able to retire, and 35% stated that they will never be able to save enough.

So in a confusing and complex investing world, how does the average American gain confidence in their ability to retire and invest well for their future?

The answer may lie in working with a professional financial adviser. According to a LIMRA Secure Retirement Institute study, 43% of U.S. pre-retirees who work with an adviser feel well-prepared for retirement, compared to just 21% of those who do not work with an adviser.

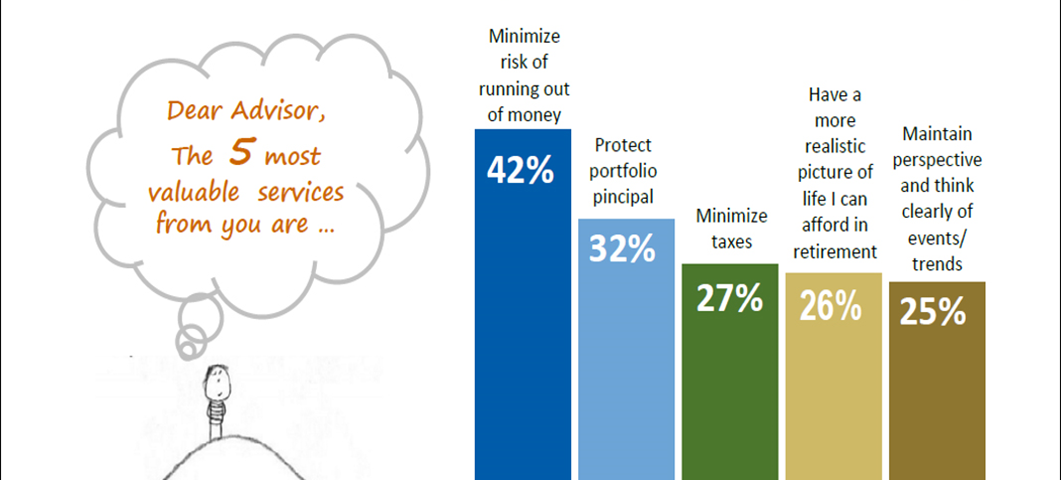

An adviser can help manage investments, give advice on new investment opportunities, and create an investor’s portfolio. Using risk-based assessments, a financial adviser can guide novice investors toward a secure retirement savings.

In addition, an adviser can assist the investor with a formal written retirement plan. LIMRA found that 67% of those with a formal retirement plan felt well-prepared for retirement, compared to only 34% of those without one.

37% of Americans think that a professional financial adviser is the best way to learn about investing, yet many are not taking advantage of this resource. Research shows that those who work with an adviser are “more likely to have a plan, have a better grasp of their financial situation, and generally feel more confident in their retirement security” (Jafor Iqbal, assistant vice president, LIMRA Secure Retirement Institute).

For more information on how a financial adviser can assist you in saving for retirement, contact us at info@ansonanalytics.com or explore our website for more information on who we serve and what we do.