The Odds of Beating the Odds

Understanding a Bear vs. Bull Market

April 21, 2017

Benchmarking Fees for 401(k) Plans

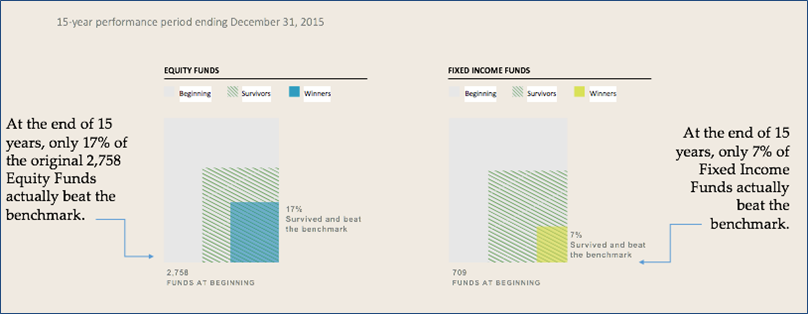

April 28, 2017Only 17% of U.S. equity mutual funds have survived and outperformed their benchmarks over the last 15 years.

When it comes to choosing the funds for a company’s 401(k) plan, the truth is that the deck is stacked against the decision-maker. A study by the Wall Street Journal proposed that an investor choosing at random through the 700-plus top-performing funds would have less than a 1% chance of picking a fund that would still be performing well in years to come. For the fiduciary of a 401(k) plan, the task of choosing their plan’s funds can seem like a daunting one.

How, then, do 401(k) plan sponsors make sure that their plan assets have the best offs at surviving and outperforming benchmarks? At Anson Analytics we believe that the use of index funds, along with a well-diversified portfolio, can help.

Whereas mutual funds rarely beat their benchmark, index funds commonly survive and surpass. The illustration below explains how uncommon it is for a mutual fund to survive and surpass a benchmark. At the beginning of the 15-year period, 2,758 equity funds, or stocks, were documented. At the end of the 15-year period, only 17% of these mutual funds had survived and beat the benchmark (1 in 5). Similarly, fixed income funds, or bonds, only had 7% survive and beat the benchmark.

Mutual funds that have professional managers who are actively choosing the funds they think will perform the best. In contrast, index funds buy all the shares that make up a particular index. For example, there is the S&P 500. The aim is to replicate the performance of that entire market. Therefore, an index fund will more commonly meet the benchmark, and possibly surpass it, making it a reliable investment option for a portfolio. After all, if there is only a 1 in 5 chance of beating the benchmark with a mutual fund, the odds are better to invest in an index fund.

Regularly analyzing and benchmarking funds within the 401(k) plan can be very useful. Funds should be diversified properly in order to achieve the best results for participants. Though diversification does not guarantee against losses, it can guide participants to reaching long-term financial goals. It can also minimize risk and reducing volatility among assets during market swings.

An Anson Analytics we construct custom risk-based or target maturity portfolios based on the demographics of a plan and the understanding that each plan is different. We analyze current funds, as well as suggest improvements if we feel that the funds do not correctly match up to the participants’ needs.

There is no guarantee for beating the odds, but we can help create diversified portfolio options that best serve a company’s plan and its participants.