Stock Market Roller Coaster

Is Sector Investing Right for Me?

June 19, 2017

6 Components of a 401(k) Investment Policy Statement

June 26, 2017The stock market is characterized by continual upward and downward movements. Though generally unpredictable in terms of length and timing, these rotating periods of contraction and expansion are inevitable. Periods of contraction are defined by the stock market value of an asset declining from its peak by 10% or more. Times of expansion are measured by the recovery of the index from the bottom of a contraction to its previous peak, and the resulting performance until it reaches the next peak before a 10% decline.

The Federal Reserve can potentially influence the direction of the market by increasing or decreasing interest rates. For example, in a recession the Federal Reserve will usually decrease interest rates, an expansionary monetary policy. With lower rates people are more likely to borrow, and the banks are more willing to lend, therefore the economy will be stimulated. When the economy booms, the Federal Reserve will often raise interest rates, therefore restricting the money supply and slowing the economy, a contractionary monetary policy. Again, the market is nearly impossible to predict, but interest rates and economic growth can correlate.

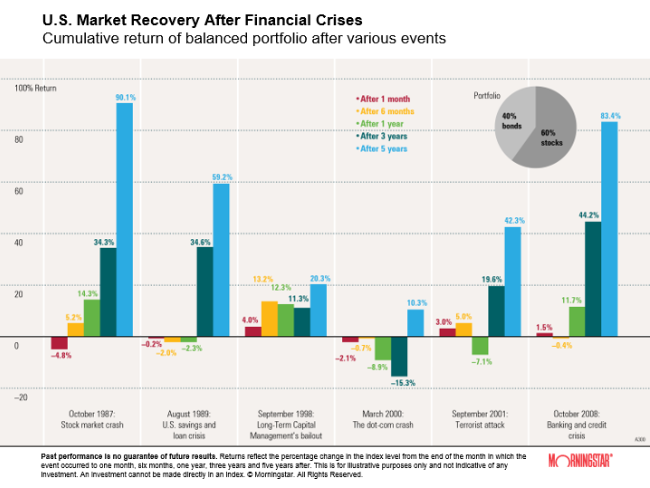

The worst market downturn our country has experienced was in 1929 when the stock market crashed and stocks lost over 80% of their value. More recently, in the US recession from 2007-2009, stocks lost 50.9% of their value. It took the market 12 years to recover from the Great Depression and 3 years to recover from the 2009 crash. Though downturns can shake the confidence of an investor, it is important to remember that over the long-run the market has grown. Even in the tough times, investors should try and weather the cycles of the markets with a long-term strategy, and not let their emotions steer their investment decisions.

A period of high returns, or a bull market, can give investors a sense of confidence that can lead to risky investment decisions. Investors choosing to see the most recent upward market movements as the inevitable future can be quite shocked when the market moves into a contraction. In order to help combat emotional investing, investors should employ a well-diversified portfolio. This can help ease the worries of a long-term investor who concerns themselves with both risk and return.

Trying to time the market can also be tempting, but it is not a great strategy to combat market fluctuations. If timing the market, an investor will try to buy in when the market is at its lowest and cash out when the recovery is at its peak. Unfortunately, it is impossible to know for certain if the market truly has reached rock bottom. Generally, when investors are patient for the long-term the market can correct itself.

Taking a step back and looking at the historical behavior of the market over the long run, it is apparent that market fluctuations can and will happen. Preparing for these ups an downs with a diversified portfolio can help investors endure these inevitable cycles.