Is Sector Investing Right for Me?

Withdrawal Risk in Retirement

June 14, 2017

Stock Market Roller Coaster

June 22, 2017Sector investing is an investment strategy that can potentially lead to high returns and strong diversification in a portfolio. While it can offer great potential, it can come with great risk too. Gaining insight into the different sectors and how they have historically correlated with each other can help investors better understand this strategy and decide if it is the right fit for them and their portfolio.

A sector is a collection of industries (groups of companies with similar lines of business) with similar characteristics. Sectors divide the economy into pieces, allowing investors and finance professionals to better analyze the economy as a whole. Investors use sectors to place stocks and investments into categories, each with its own characteristics and risk profiles. Some examples of sectors include:

- The Primary Sector: This sector is made up of companies that participate in the extraction and harvesting of natural products from the earth.

- The Secondary Sector: Companies that are involved in processing, manufacturing, and construction

- The Third Sector: Companies that provide services such as sales, entertainment, or financial organizations

- The Fourth Sector: Companies that are in intellectual pursuits, such as educational businesses

Sector investing is choosing an investment fund that targets a particular economic sector. Just like stocks, sectors experience volatility, and therefore results are not guaranteed. Typically, sectors fluctuate based on factors like revenue growth and the supply/demand for products or services.

In the past few years this type of investing has been popular with investors that are seeking to beat the market with above-average returns. Since sectors are concentrated, they have the potential to achieve higher returns than the regular market. Sector funds are alternatives to traditional investments, and therefore can also add to portfolio diversification. With greater returns, though, come greater risks. Because investors are concentrating investments into a specific sector, there is the possibility of substantial loss if that sector suffers a decline.

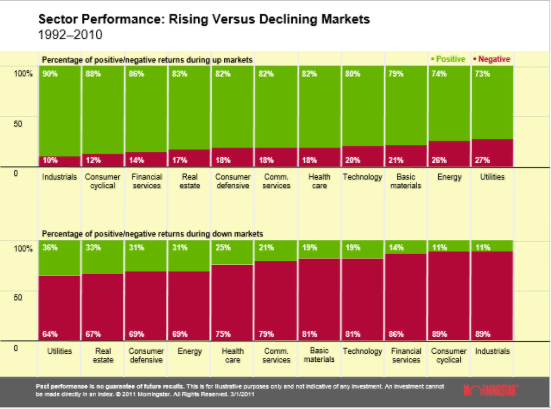

Historically, different sectors react better to different market movements. The goal of sector investing is to capitalize on market movements by investing in the sectors that will perform the strongest during a particular time in the economic cycle. For example, when the economy is rebounding from a recession, those sectors that are sensitive to changes in interest rates might do better.

Generally, in a bull market, sectors such as energy, real estate, and technology tend to outperform. In a bear market, where the economy has taken a downturn, sectors like healthcare, utilities, and consumer defensive tend to achieve higher returns relative to the market. Some sectors, such as technology and/or energy, perform better in periods of high inflation. Different sectors have different characteristics and if well understood they can potentially provide strong returns in the long run.

Sector investing allows investors to try and take advantage of different market stages, but it is important to note that sector investing is not for everyone. It does have a high risk profile, so an investor must be willing to experience grand highs and deep downturns. For some investors, it may serve to fill a gap, for others it may be a piece of a balanced asset allocation strategy. Sector investing can be useful as part of overall portfolio management, but one must be prepared to follow these funds closely and understand how sectors tend to perform in each economic cycle.