The Impact of Compounding Interest

Investing in International Markets

July 5, 2017Alternatives for College Funding

March 1, 2018Potentially one of the most important pieces of fundamental investment knowledge is that of compounding interest. A concept thought to have originated as early as the 17th century, there are detailed equations used to compute it but compound interest can simply be explained as “interest on interest”. When an investment compounds, interest is earned both on the principal and on the previously gained interest. This causes the sum of the investment’s principal and interest earned to grow at a faster rate.

This concept is especially pertinent for young investors. The earlier that an investor begins saving, the more returns they will likely have at retirement. Even if there is only a small amount to invest in the beginning, the total potential savings could increase dramatically with an earlier start. The more time an investment has to compound, the greater the potential return. An investor who begins saving early, but saves for less time, can actually make more returns than an investor who begins later but saves longer.

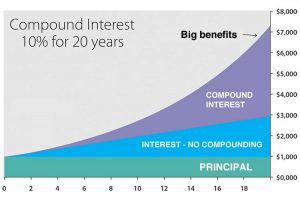

There are three things that can influence the rate at which money compounds in an account. The first is the interest rate earned on the investment. A higher interest rate will contribute to a stronger rate of compounding. The second is the length of time that money can be left to compound. The longer the money can sit uninterrupted, the bigger the returns can be. The third factor that influences compound interest is the compounding frequency or the number of times per year in which the accumulated interest is paid out. The basic rule of thumb for this is that the higher the number of compounding periods, the greater amount of compound interest. It may sound complicated but the simple graph below can show the difference in how money can grow over the same time period using simple interest versus compounding interest.

Compounding interest is a key concept in understanding wealth building. It can transform the savings of an investor if it is understood and taken advantage of early. You don’t have to know all the mathematical equations behind it to grasp the basic idea. In the words of the genius Albert Einstein, “Compound interest is the eight wonder of the world. He who understands it, earns it. He who doesn’t, pays it”.

We’d love to discuss this more if you have any questions. Please don’t hesitate to visit our website at www.ansonanalytics.com or give us a call at 678.216.0795. We’d love to hear from you.

1 Comment

[…] is when the earnings on your investment starting creating earnings of their own. I really like how Investopedia defines […]