For investors keeping a watch on the stock market and their portfolios recently, there might be questions regarding the decision to diversify. U.S. stocks have been steadily increasing since the election, which should mean good news for an investor’s portfolio. Unfortunately, bonds, gold, and many other assets have been dramatically falling. The rise of stocks and the fall of other asset classes are basically canceling each other out in portfolio returns.

In addition, U.S. stocks have been dominating over International stocks for the last few years. Since 2012, the U.S. share of global stock market capitalization has gone from roughly 35% to slightly more than 40% of the total (Wall Street Journal).

If U.S. stocks are the only thing rising, then is it time to give up on diversification? Should investors be rushing to gain portfolios made fully of US stocks and give up on bonds and International asset classes? The short answer is no, but let’s explore why.

First, the market is currently reacting to the perceived ideas of how President Trump’s possible policies will impact the market in the future. People thing that his proposals to cut taxes, spend on infrastructure, and roll back regulations will boost the economic growth and lead to a rise in inflation.

Again, these are assumptions based on what might possibly happen. If it does happen as assumed, stocks will continue to rise as other assets fall. But this assumption is just one interpretation of what might happen with President Trump in office. There are many outcomes that have not been considered, let alone reflected in the market. If our assumptions do not become reality then diversification will most likely start looking good again.

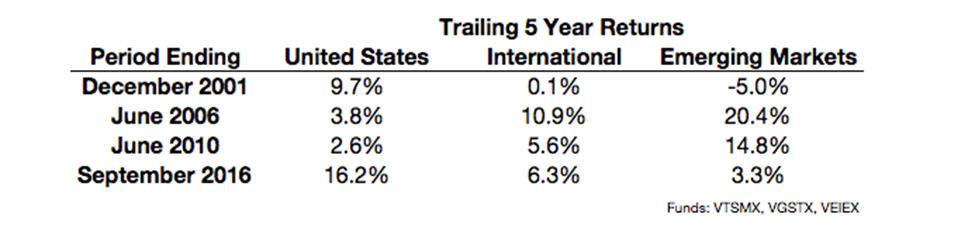

Second, the market works in cycles. Take a look at the chart to exemplify. The performance spreads in 2001 had completely reversed by 2006, and did not come full circle again until 2016. Even with these cycles, the 15-year returns of the funds look pretty much the same:

United States +7.8%

International +6.3%

Emerging Markets +7.3%

The point is that the market changes. This is why we always urge investors to stick around for the long run. Do not panic about diversification right now. The future cannot be predicted one way or the other so investors must simply settle down for the long term and let the market work itself out. At some point the tides of the market will turn to favor something else. No one knows when, how, or what comes next.

In the midst of what is happening in the market right now, investors must continue to diversify.

Agribusiness: A New Investment Opportunity

March 31, 2017Participant Education and the 401(k)

April 7, 2017

Show allIs Diversification a Thing of the Past?

For investors keeping a watch on the stock market and their portfolios recently, there might be questions regarding the decision to diversify. U.S. stocks have been steadily increasing since the election, which should mean good news for an investor’s portfolio. Unfortunately, bonds, gold, and many other assets have been dramatically falling. The rise of stocks and the fall of other asset classes are basically canceling each other out in portfolio returns.

In addition, U.S. stocks have been dominating over International stocks for the last few years. Since 2012, the U.S. share of global stock market capitalization has gone from roughly 35% to slightly more than 40% of the total (Wall Street Journal).

If U.S. stocks are the only thing rising, then is it time to give up on diversification? Should investors be rushing to gain portfolios made fully of US stocks and give up on bonds and International asset classes? The short answer is no, but let’s explore why.

First, the market is currently reacting to the perceived ideas of how President Trump’s possible policies will impact the market in the future. People thing that his proposals to cut taxes, spend on infrastructure, and roll back regulations will boost the economic growth and lead to a rise in inflation.

Again, these are assumptions based on what might possibly happen. If it does happen as assumed, stocks will continue to rise as other assets fall. But this assumption is just one interpretation of what might happen with President Trump in office. There are many outcomes that have not been considered, let alone reflected in the market. If our assumptions do not become reality then diversification will most likely start looking good again.

Second, the market works in cycles. Take a look at the chart to exemplify. The performance spreads in 2001 had completely reversed by 2006, and did not come full circle again until 2016. Even with these cycles, the 15-year returns of the funds look pretty much the same:

United States +7.8%

International +6.3%

Emerging Markets +7.3%

The point is that the market changes. This is why we always urge investors to stick around for the long run. Do not panic about diversification right now. The future cannot be predicted one way or the other so investors must simply settle down for the long term and let the market work itself out. At some point the tides of the market will turn to favor something else. No one knows when, how, or what comes next.

In the midst of what is happening in the market right now, investors must continue to diversify.

Samuel J. Sweitzer

Related posts

Bonding with your portfolio

Read more