Step by Step: Improving 401(k) Plan Outcomes

Tips for Maintaining Wealth

April 14, 2017Understanding a Bear vs. Bull Market

April 21, 2017The 401(k) is an important component of an employee’s retirement, and a well-run plan can be the star of an organization. As an employer, one’s goal should be to guide participants toward their retirement goals through the 401(k) provided. Here are a few steps that could help increase participation and assist participants in reaching a successful retirement.

1. Adopt Automatic Features

When employees are enrolled in a plan with automatic features, like automatic enrollment or contribution escalation, they are more likely to stay in the program. In fact, less than 10% of participants actually opt out (2015 Plan Sponsor Survey: Focus on Automatic Plan Features [DCIIA], June 2015).

Consider automatically enrolling all employees, not just new hires, and re-enact the enrollment every year. Potentially increasing default contribution rates to 6% or setting the default automatic increase rate to 2% is likely to increase the probability of participant success in retirement.

2. Select an Appropriate Target Date Fund (TDF)

Many plan sponsors and participants lack the confidence that the participants can appropriately allocate assets on their own. TDFs help by providing age-appropriate diversification through professionally-managed portfolios that hold less risk as participants move toward retirement. TDFs generally have less volatility due to their diversified nature. When managed by a professional rather than a participant they also hold less extreme outcomes. Planning goals and objectives, and documenting the process, are both key to the success of implementing a TDF.

3. Conduct a Re-Enrollment

Though TDFs are generally better suited for participants due to their ability to be age appropriate, many participants may still choose not to adopt one. In this case, one strategy for implementation can be re-enrollment. Re-enrollment can be the push participants need to get invested in the TDF option.

A plan re-enrollment helps participants plan better for their future by defaulting them into a qualified default investment alternative, while still allowing participants to opt out if they are interested in taking a more active role. Plan sponsors that conduct a re-enrollments generally see a 55%-85% TDF adoption rate, while those that simply add TDFs as a new option only see a 5% adoption rate (J.P. Morgan retirement research, 2014).

4. Optimize the Core Menu

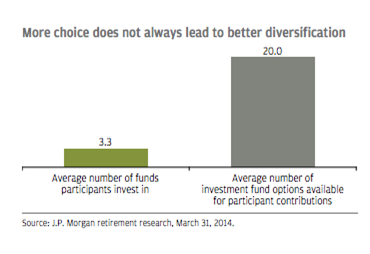

For those plan participants that want a more active role, a streamline core menu can be helpful. Too many investment options on a core menu can be confusing for participants and may lead to misallocation.

The average participant actually invests in fewer than four funds, so it may help to provide fewer, more sophisticated, choices in order to lead participants toward diversification and professional management. Try consolidating the core me

nu into three investment portfolios: diversified stocks, diversified bonds, and diversified cash alternatives.

Provide a single point of entry for well-diversified portfolios, ensuring that professional managers are actively driving asset allocation and portfolio construction.

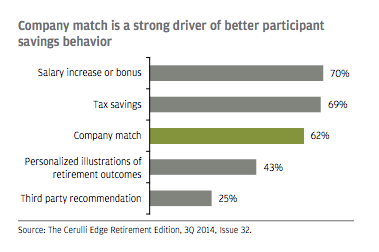

5. Leverage the Employer Match

An employer match program provides greater incentive for employees to contribute to their 401(k) plan. When a company matches, many participants feel more confident about increasing their contributions. Leveraging this will help lead participants to a more successful retirement.

We hope that these suggestions have been helpful. The 401(k) should fulfill its purpose of guiding employees toward a better retirement, and we believe that following these steps can help. For further information or guidance, please feel free to contact us at info@ansonanalytics.com

1 Comment

Kudos to you! I hadn’t thhgout of that!