The Strategy of a Diversified Portfolio

6 Components of a 401(k) Investment Policy Statement

June 26, 2017

The Nuances of ERISA 404(c)

July 3, 2017One of the most common views among investment professionals is that a diversified portfolio is key in reaching long-term financial goals. The aim is to invest in different areas of the market that would react differently to the same event. Therefore, investors who diversify are likely to lower their investment risks and experience more stable returns.

Typically, the longer an investor has to invest, the riskier their portfolio can be. After all, there is more time for the market to straighten itself out. It is wise to remember, as we consider asset allocation, that as an investor ages their ideal asset allocation may change. This can be based on the amount of time until retirement or a possible decreased risk tolerance later in life.

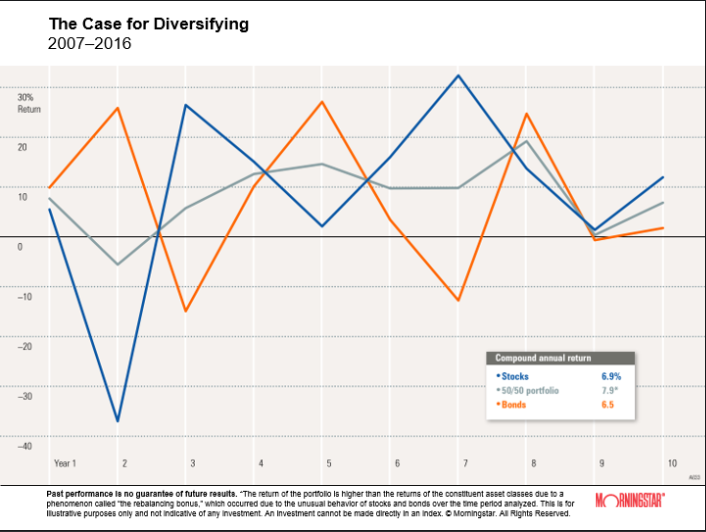

Asset allocation is the task of dividing a portfolio among different asset classes, such as stocks, bonds, and cash. This can help to protect against significant losses since stocks, bonds, and other assets react to different market conditions. For example, if a portfolio is spread out among the assets and the bond market starts to decline, stocks might be simultaneously seeing positive returns. This can reduce an investor’s risk by evening out the losses and returns.

As far as assets go, stocks generally have the greatest amount of risk, but also the highest returns. They have great potential for growth, but with a lot of volatility. Bonds, on the other hand, are generally less volatile than stocks but their returns are more modest. The third asset class, cash, has the lowest returns of the three but is considered to be relatively safe. The main concern with cash is the risk of inflation, which would in turn decrease the value of this asset. Other asset classes that can be used to diversify a portfolio include precious metals and real estate.

Diversification is not simply about spreading investments over different asset classes, but also about spreading out among different investments within those assets. Diversification allows an investor to be less dependent on any one single asset class and potentially reduce risk. Ideally, one would combine investments that behave differently during changing economic conditions. Investments with different return and risk behavior can potentially help guard a portfolio from major losses.

When the market is performing badly there are bound to be losses, but a diversified portfolio generally experiences less severe monthly volatility than stocks or bonds alone. Stock prices typically fluctuate more than bond prices, but both are subject to price movements.

One way to decide what assets should be combined in a portfolio is by determining the correlation between asset classes. Mixing asset classes that tend to move up and down at different times can help offset market downturns. For example, small stocks and intermediate-term government bonds have a negative correlation, showing their potential for better diversification. Of course, investments should not be judged on their diversification value alone, but understanding asset class behavior can potentially help enhance portfolio diversification benefits.

Though diversification might not always result in the highest returns, it can protect an investor from experiencing extreme losses. For example, in 2016 a diversified portfolio would have returned 8.2%, approximately 17.4% lower than the top asset class that year. However, it outperformed the worst-performing asset class by about 8.0%. Diversification will never entirely eliminate risk, but it can help decrease it.

Only chasing the highest returns and ignoring sound investment strategies, such as diversifying a portfolio, can be dangerous. Choosing to be patient and setting up investments to weather the ups and downs of the market can help investors see stable returns over the long run.