Do I Choose Active or Passive Management?

6 Steps to a 401(k)

January 25, 2017

Emerging Economies and the Digital Age

March 10, 2017When it comes to investing, we strive to make the right choices in order to receive the best return with the least amount of risk. In order to achieve this goal there are many decisions to be made, and though investors might think they understand each piece of the investing puzzle, it is sometimes helpful to simplify the terminology down once again.

One of the commonly debated decisions is whether to go with active or passive management. Simplified down, what is the difference between active and passive management and which should be chosen by the investor? Based simply on assumptions regarding the depth of investor involvement, one might sound more appealing than the other, but it is important to know how to make the right choice based on the facts.

Active management is most commonly accessed through investing in mutual funds. This strategy looks to outperform the market based on a certain benchmark. A fund manager will buy and sell stocks with the purpose of trying to outperform a specific stock index. This requires attention to market trends, economic shifts, and other factors that could affect companies within that index.

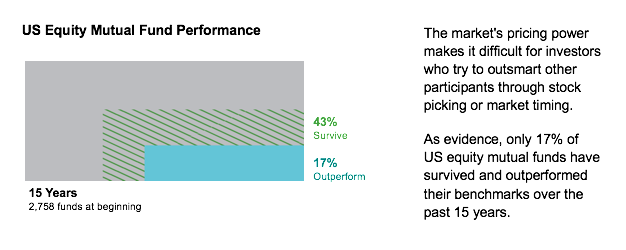

The goal is to pick “winning” stocks and take advantage of market shifts and changes. The hope is for a greater return, but in reality only a small percentage of managers actually beat their benchmark.

The second option is passive management, which looks to hold a particular index or index fund. This technique leads the manager to create a portfolio that is the same as a specific index of the market. The manager looks at all of the stocks within an index and simply creates a portfolio that matches it. Money gets automatically invested into individual stocks and bonds to their market capitalization in the index.

The second option is passive management, which looks to hold a particular index or index fund. This technique leads the manager to create a portfolio that is the same as a specific index of the market. The manager looks at all of the stocks within an index and simply creates a portfolio that matches it. Money gets automatically invested into individual stocks and bonds to their market capitalization in the index.

The goal is to create a return that meets the benchmark, instead of trying to outperform it.

Index funds are generally a safe way to invest in a broad segment of the market. Being “passively” managed they have more of an autopilot feel, and have a bit less capacity for human error. The passive nature makes them pretty easy to invest in, both for the experienced and the inexperienced investor. Generally they have lower portfolio turnover and are lower in cost. Many times this option can be less risky and less costly.

Though we find passive management to be a strong choice for investors, in the end the decision rests on risk, cost, and the best fit for your investments.