Your changing definition of risk in retirement

Anson’s Monthly Planner | Q3 | September 2019

September 6, 2019

All about inflation: Your purchasing power in retirement

September 19, 2019During your accumulation years, you may have categorized your risk as “conservative,” “moderate,” or “aggressive,” and that guided how your portfolio was built. Maybe you concerned yourself with finding the “best-performing funds,” even though you knew past performance does not guarantee future results.

What occurs with many retirees is a change in mindset — it’s less about finding the “best-performing fund” and more about consistent performance.

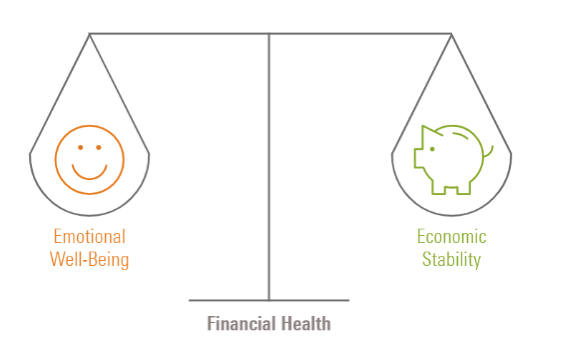

It may be less about a risk continuum — that stretches from conservative to aggressive — and more about balancing the objectives of maximizing your income and sustaining it for a lifetime.

You may even find yourself willing to forego return potential for steady income. A change in your mindset may drive changes in how you shape your portfolio and the investments you choose to fill it. Let’s examine how this might look at an individual level.

Still Believe. During your working years, you understood the short-term volatility of the stock market but accepted it for its growth potential over longer time periods. You’re now in retirement and still believe in that concept. In fact, you know stocks remain important to your financial strategy over a 30-year or more retirement period.

But you’ve also come to understand that withdrawals from your investment portfolio have the potential to accelerate the depletion of your assets when investment values are declining.

How you define your risk tolerance may not have changed, but you understand the new risks introduced by retirement.

Consequently, it’s not so much about managing your exposure to stocks but considering new strategies that adapt to this new landscape. Keep in mind that the return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

Talking to an expert helps. No one can predict the future — and if they claim that they can, run away as fast as you can. Regardless of your background, a good financial plan considers your specific, unique background as well as your risk tolerance level

“A person’s perspective on time was far more influential than income, age, education, or gender when it came to personal finances.” People who think into the future focus on their savings compared to those with time horizons of less than a year.”

— Morningstar

The march of time affords us ever-changing perspectives on life, and that is never truer than during retirement.